30 Jul, 2024 | Admin | No Comments

How Smart Investors Decipher & Respond to Real Estate Market Cycles

For real estate investors to be successful, they must understand the market dynamics. The real estate cycle can be incredibly complex, but it can also be categorized into four relatively simple phases. A smart investor will take the time to stay up-to-date on market trends to understand where the market is, where it’s going, and how that impacts their investment strategy.

What Is the Housing Market Cycle?

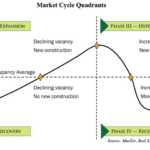

The real estate cycle is the natural process of growing, expanding, and receding in the real estate market. It’s generally divided into four stages: recovery, expansion, hyper-supply, and recession. Each cycle phase is unique and impacts the real estate market differently, like price, vacancies, and inventory.

People generally estimate that the real estate market cycle takes an average of between 10-18 years. However, this can change pretty drastically depending on some of the factors that affect the market. Many different things affect the natural flow of real estate cycles, like the following:

- Interest rates

- Economic health

- Demographics

- Government policies

- Real estate development

- Business growth

- Employment rates

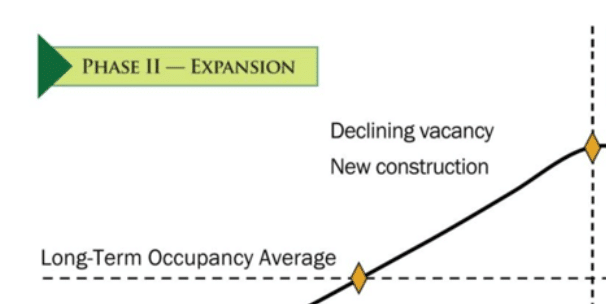

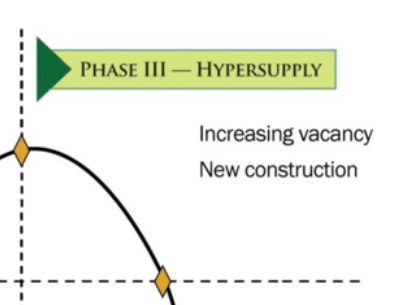

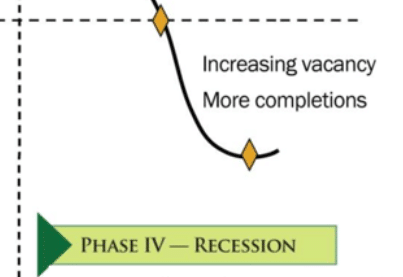

Use this real estate cycle chart to help identify the state of the market (we’ll use this chart throughout the article to show the various stages):

Why Investors Need to Understand the Cycle

If you want to be a successful real estate investor, you need to understand the market beyond a real estate cycle chart. Investing is a long-term strategy, and it’s easy to make poor decisions if you don’t understand how the market naturally ebbs and flows. Understanding the real estate market cycles will help you to do the following:

- Know when the optimal times are to buy and sell

- Adjust your pricing strategies for buying and selling based on the state of the market, demand, and pricing changes

- Generate a higher profit because you have a long-term perspective

- Avoid poor investments by making choices before the market makes a downturn

Understanding the housing market cycle is essential to make profitable investments. Learn how to plan even more effectively in our guide to making a real estate investment business plan.

Stages of the Housing Market Cycle

At any point, many factors affect the real estate market. However, every change in the market can fit into one of four stages of the real estate cycle: recovery, expansion, hypersupply, and recession.

1. Recovery

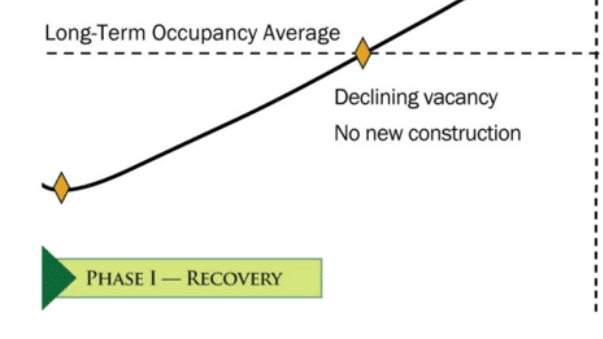

The first part of the real estate cycle is right after a recession when the market is trying to recover. At the beginning of the recovery phase, people still feel the effects of the recession. There is typically an excess supply of properties that doesn’t match a decline in demand. This phenomenon creates a drop in the prices of rent and properties.

What investors should do during recovery:

- Purchase below-market properties (best to do in the early stages of recovery)

- Sell renovated properties that were purchased during a recession

- Negotiate property prices to get undervalued properties or the best value for your flipped homes

2. Expansion

As recovery continues, some call parts of this phase “the honeymoon.” This is when the general economy is growing, employment rates are starting to improve, and demand for real estate is increasing. You’ll see signs of the expansion phase when properties sell more quickly, rent prices are starting to increase, and there is a higher competition for bank foreclosures. This is the part of the real estate cycle when supply and demand are the most balanced.

What investors should do during expansion:

- Research growing areas to invest in locations that are in high demand

- Renovate or develop properties (high demand justifies the cost)

3. Hypersupply

The next part of the housing market cycle is when the pendulum swings a little too far in the opposite direction, and now the supply of real estate exceeds the demand for it. This can be caused by overbuilding during the expansion phase. Watch for this part of the real estate market cycle by looking for low unemployment rates, quickly selling properties, and increases in property and rent prices.

It’s common for some investors to panic when they find themselves in this spot on the housing market cycle graph because they know a recession is coming. You can always liquidate your assets, but it’s often a wise strategy to hold properties and generate short-term cash flow. However, it’s smart to prepare for an upcoming recession by adjusting your pricing strategy.

What investors should do during hypersupply:

- Hold properties and let them appreciate

- Focus on generating short-term cash flow

- Prepare for upcoming recession

4. Recession

Of all the real estate market cycles, the recession stage is the most daunting for investors. At this point, there is an overabundance of inventory that surpasses demand. This means there are more vacancies, and prices start to fall again. During this stage, job growth slows down, leaving fewer buyers and renters to fill your rentals. At the same time, home values increase more quickly. Even though recessions are typically challenging for rental property owners, slow periods of the economy are the best time to invest in real estate.

What investors should do during a recession:

- Buy distressed, undervalued properties with high long-term potential

- Look for distressed properties or those in foreclosure

- Develop a long-term rental or flip strategy for investments

Frequently Asked Questions (FAQs)

What are the four cycles of real estate?

The four stages of the real estate cycle are recovery, expansion, hyper-supply, and recession. They are closely connected to the economy, so it’s important to understand various factors that affect the real estate market.

How long is the housing market cycle?

Real estate cycles can move quickly or stay consistent for varying amounts of time. Although there isn’t a specific time period, most cycles last anywhere from 10 to 18 years.

What phase of the real estate cycle are we in in 2024?

In the middle of 2024, we’re seeing high interest rates, high home prices, and slow moving home sales. Even though 56% of Americans believe we’re in a recession, experts don’t agree. In fact, sources like Bankrate predict the market will improve slightly since there is still a low and high level of demand.

Bringing It All Together

Understanding the real estate market cycle can be overwhelming at first, but it’s an extremely important concept to master for aspiring real estate investors. Make sure to understand the ins and outs of each part of the cycle and learn how to recognize shifts in the housing market cycle to make the best decisions for your business.

The post How Smart Investors Decipher & Respond to Real Estate Market Cycles appeared first on The Close.

Before diving into investments, you need to fully understand what cash flow in real estate is all about. Cash flow is the net amount moving in and out of your real estate investment—obviously, an important number to keep track of. It gives a metric for how an investor will know the profitability of a property. Without understanding cash flow, you might have a property that is losing money rather than profiting. Let us take a closer look at what cash flow from real estate is, its importance, how to measure it, drivers, and tips to increase it.

What Is Cash Flow in Real Estate?

Cash flow in property investment simply refers to the difference between the money you take in and what you spend. Positive cash flow means your income exceeds your expenses, and negative cash flow indicates the opposite.

It’s a very simple concept but fundamental to real estate investment practices. A positive cash flow will provide an investor with continuous income and financial stability to reinvest in more properties. Understanding cash flow from real estate will help you make informed buying, holding, and selling decisions regarding property.

Why Do Investors Care About Cash Flow From Real Estate?

Cash flow is the lifeblood of real estate investing. It will dictate whether the property will become a financial liability or an asset. Consistent cash flow can provide for mortgage, maintenance, and other expenses. This padding in your bank account will help safeguard against market downturns or other cost surprises. High cash flow properties will also appreciate over time and increase your overall portfolio. The objective of anyone diving into real estate investing is to get the highest return on their investments.

How to Calculate Cash Flow in Real Estate

Any serious real estate investor must learn to calculate cash flow. The investor will use these equations to understand the property’s profitability and thus be able to make a decent investment decision accordingly. Beyond the cash flow formula, you can use other valuable calculations to enhance the analysis: the CAP rate and the 1% rule. Here are the formulas for the necessary calculations:

Real Estate Cash Flow Formula

This formula helps determine the profitability of a property by calculating the net income after all expenses.

Cash Flow = Total Rental Income − Total Operating Expenses (Operating Expenses + Vacancy Costs + Repair Costs)

Example of positive cash flow: Imagine you own a rental property that generates $3,000 per month in rental income. Your monthly operating expenses, including mortgage payments, property taxes, insurance, maintenance, and management fees, total $2,000.

Using the cash flow formula:

$3,000 − $2,000 = $1,000 (Cash Flow)

In this example, the property provides a positive cash flow of $1,000 monthly, indicating a profitable investment.

Example of negative cash flow: Let’s take the example above with a property generating $3,000 per month in rental income, but now the monthly operating expenses are $4000 because this property has a higher property tax and additional maintenance that must be paid for monthly.

Using the cash flow formula:

$3,000 − $4,000 = -$1,000 (Cash Flow)

This example showcases a negative cash flow that indicates this wouldn’t be a profitable investment.

1% Rule Calculation

The 1% rule is a guideline for a quick and easy way to check that the rental income will more than likely pay off most expenses, indicating some possible positive cash flow. Keep in mind that it is an estimation. Here’s how to calculate it:

- Determine the purchase price: Find out the total cost of the property, including any closing costs and necessary repairs or upgrades.

- Calculate 1% of the purchase price: Multiply the purchase price by 1%.

Purchase Price × 1% (0.01) = Estimated Cash Flow

Example 1% rule calculation: Suppose you are considering buying a property for $200,000. To apply the 1% rule:

1% of Purchase Price = $200,000 × 0.01 = $2,000 (Estimated Cash Flow)

According to the 1% rule, the property should generate at least $2,000 monthly rental income to be considered a good investment. If the expected rental income meets or exceeds this amount, the property will likely provide positive cash flow, making it a potentially sound investment.

Cap Rate

Using the cap rate formula, also known as the capitalization rate, will be beneficial when comparing the potential return on investment among different properties. This calculation is more complicated and involves a few extra steps.

Net Operating Income (NOI) / Purchase Price = Cap Rate

Step 1: Determine net operating income (NOI): Calculate the annual rental income and subtract all operating expenses.

Total Rental Income − Total Operating Expenses = NOI

John owns a rental property that generates $3,000 monthly in rental income, totaling $36,000 annually. His annual operating expenses, which include mortgage payments, property taxes, insurance, and maintenance, amount to $1,000 per month, or $12,000 per year. Calculate his NOI below:

$36,000 (Rental Income) − $12,000 (Operating Expenses) = $24,000 (NOI)

Step 2: Determine Purchase Price: Find out the total purchase price of the property. The total purchase price can include the property cost, closing costs, inspection fees, and necessary repairs or renovations.

$250,000 (Property Price) + $15,000 (Closing Costs) + $34,600 (Repairs/Renovations) + $400 (Inspection Cost) = $300,000 Purchase Price

Step 3: Calculate the Cap Rate using the above formula (NOI / Purchase Price = Cap Rate)

$24,000 (NOI) / $300,000 (Purchase Price) = 0.08 or 8% (Cap Rate)

In this example, the property has a cap rate of 8%. This percentage means the property generates an 8% return on investment based on its net operating income. A higher cap rate generally indicates a more profitable investment.

What Factors Affect Cash Flow?

Several factors may impact cash flow in real estate investing, so it will be important to understand the variables to maintain positive cash flow. Here are the critical elements that influence cash flow most:

- Expenses: Large negative cash flow items include operating expenses like mortgage payments, property taxes, insurance, maintenance, utilities, and property management fees. Other current and nonrecurring expenses that impact your profitability might include major repairs or emergency maintenance.

- Rental income: How much you can charge for rent depends on location, property condition, and market demand. High vacancy or high turnover rates lower rental income, hurting cash flow.

- Rental vacancies: The more vacant a property is, the less rental income will be collected. Effective tenant retention strategies and rigorous screening processes will help minimize vacancies and keep cash flowing.

- Market conditions: Economic conditions, interest rates, and local real estate markets drive rental rates and property values. Shifts in these can negatively or positively affect cash flow.

- Property management: Good property management keeps rent collection, maintenance, and tenant relations in check to provide steady cash flow. Poor management increases vacancies and raises expenses, which will cut profit margins.

By keeping these factors in control, investors can have an inflow of cash to make real estate investing profitable and sustainable.

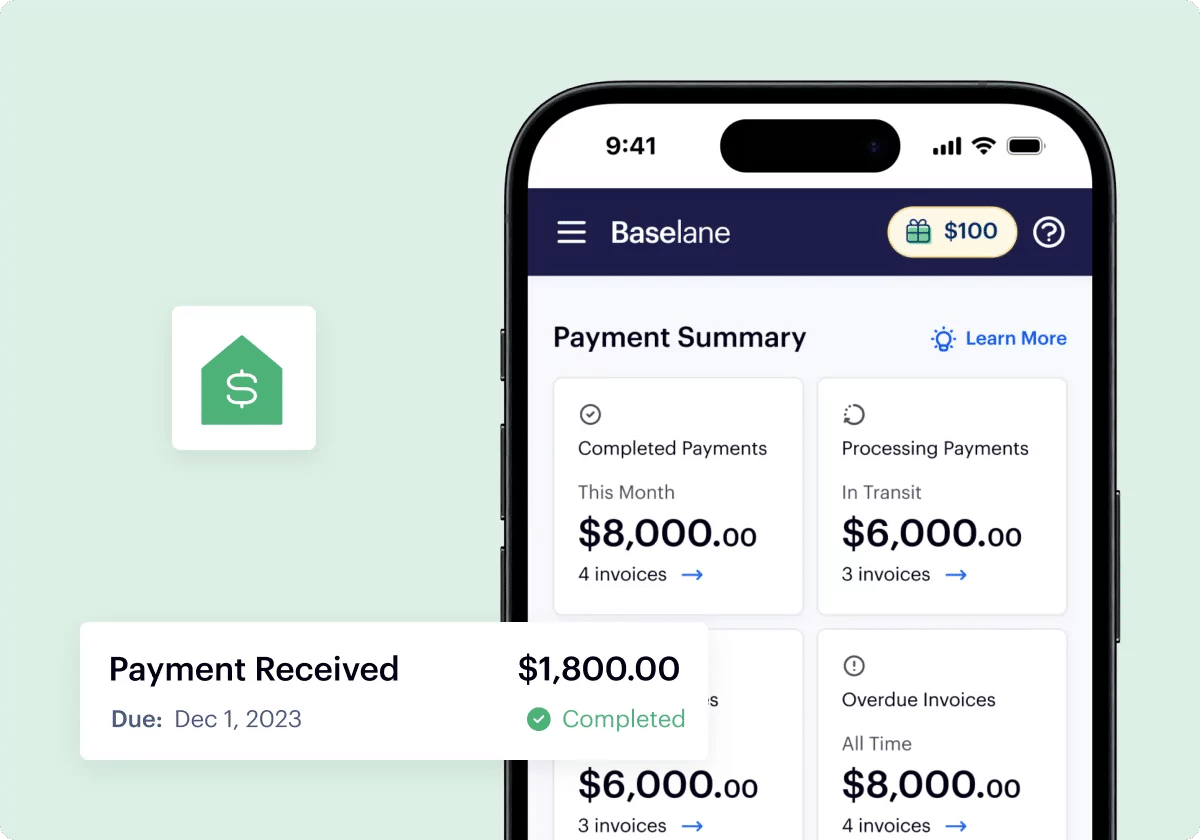

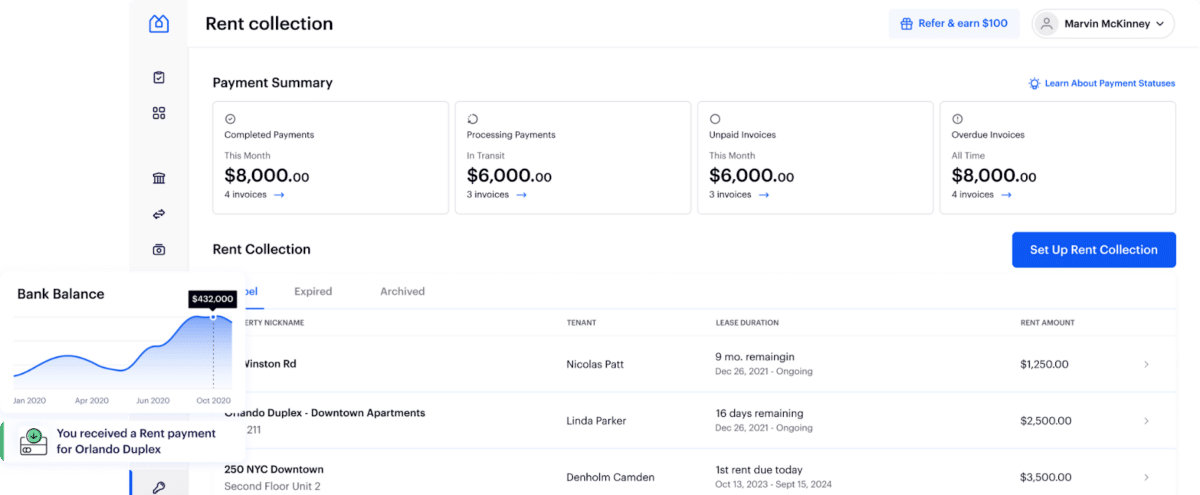

Baselane’s rent collection platform is an excellent avenue to stabilize your rental income. Baselane provides automated payment reminders and seamless online payment options to minimize late or missing payments. This ensures timely reception of your rental income every single time. The platform also provides detailed tracking and reporting features that allow landlords to monitor payments and manage finances more efficiently.

Baselane will help property owners maintain consistent income, reduce administrative work, and focus more on growing real estate investments.

Tips to Increase Cash Flow

Increasing cash flow in real estate requires raising income and reducing expenses. Having a strategic approach to managing your properties as a part of your investing business plan can radically improve profitability. Here are some hands-on tips for maximizing the cash flow of your real estate:

- Increase rental income: Renovate the property, add amenities, consider short-term rentals, and adjust the rent to make it more marketable.

- Reduce vacancies: Enforce tenant screening and incentives for lease renewal, and maintain good relations with tenants.

- Lower operating expenses: Check insurance rates, compare property management fees, maintain the property, and invest in energy-efficient upgrades.

- Optimize financing: Refinance your loan, pay off that high-interest debt, and find alternative ways to finance your purchases.

- Increase efficiency: Implement real estate management software, preventative maintenance, and monitor cash flow regularly.

Frequently Asked Questions (FAQs)

What is a good cash flow ratio in real estate?

A good cash flow ratio in real estate simply means that a property generates enough income to comfortably pay most of its expenses, leaving room for unexpected costs. Generally, investors look for at least a 1.25 cash flow ratio, meaning that for every dollar of expenses, the property brings in $1.25 in income. This ratio ensures that a property will not only be able to cover its financial obligations but also offer its owners some profit, hence making it a reliable and sustainable investment.

How do you make sure a property’s cash flows?

Thorough research and due diligence before buying an investment can easily ensure a property’s cash flow is positive. Analyze the local rental market to get a feel for demand and competitive rental rates. Calculate with precision all possible expenses when investing, including mortgage payments, property taxes, insurance, maintenance, and management fees. Offering property upgrades or adding amenities will justify higher rents for better and more reliable tenants.

What type of real estate has the most cash flow?

Multifamily properties generally create the most cash flow because you have several units in one property, therefore multiple income streams. These typically have lower vacancy rates and spread maintenance costs over many tenants, making them much more profitable overall. Short-term rentals within heavily tourist-demand areas may also provide significant cash flow during peak seasons. When selecting the kind of real estate to invest in, investors should carefully consider local regulations and market conditions to achieve maximum cash flow.

Bringing It All Together

Positive cash flow in real estate is considered the central factor in any successful property investment. After all, the objective of investing is to make money, right? Every investor must take time and perform due diligence before investing in any property. That includes performing market analysis, properly calculating potential income and expenses, and considering improvements needed for the property to gain a higher rental value.

Look for properties with potential for solid cash flow, such as multifamily units or short-term rentals in hot spots. Run those properties professionally, tracking their financial performance closely to adjust your strategy as you go. Keeping an eye on financial performance and tweaking your plan as needed will help keep that cash flowing to ensure your real estate ventures are not just profitable but can also provide you with some enjoyment.

The post Cash Flow in Real Estate: Overview, Definition & Calculations appeared first on The Close.

What does BRRRR mean? Hint: it does not mean you’re cold—it means your real estate game is heating up! If you’re just getting started as an investor, the BRRRR method might be your best friend. It’s a well-defined, tried-and-true investment strategy that offers the best opportunity to build passive income through real estate. Since BRRRR is a pretty lengthy acronym, I’ll walk you through the step-by-step instructions to understand what it means and how to use the BRRRR strategy.

What Is the BRRRR Method?

“BRRRR” is an acronym for buy, repair, rent, refinance, and repeat. It can be done by anyone who can purchase a property, allowing investors to build equity immediately after renovating or repairing it by doing a cash-out refinance. Plus, the exact process can be repeated over and over, massively increasing your equity and investment portfolio.

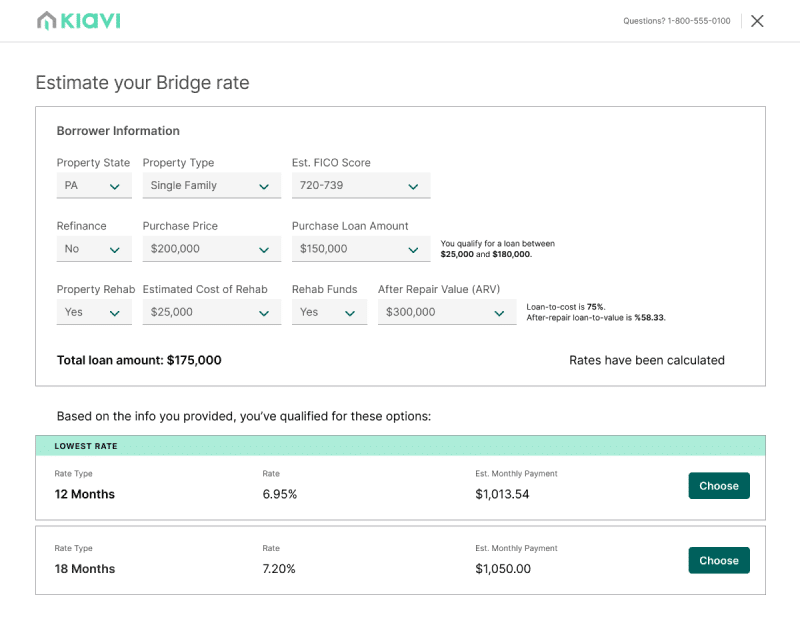

The price of rent has jumped 30.4% nationwide between 2019 and 2023, so renting out a property is likely to be profitable. However, learning as much as possible before diving into any real estate investing strategy is always important. To find out if BRRRR is right for your next project, check out Kiavi’s free Breaking Down BRRRR e-book below. It covers the method’s pros and cons, tips for getting the right loan for your project, and even the best home rehab trends to attract high-income tenants.

Why the BRRRR Method Is an Excellent Investment Strategy

BRRRR investing enables you to build a portfolio without buying properties in cash. Because you will do a cash-out refinance once the property has been renovated and leased, you’ll make a quick profit that you can use to reinvest in another property while enjoying the advantages of owning a rental.

When done correctly, the BRRRR method can grow your net worth, generate passive income, and eventually lead to financial independence by enabling you to own and rent real estate uniquely and continuously. Here are some of the more specific pros and cons of using the BRRRR strategy to invest in real estate:

| Pros | Cons |

|---|---|

|

|

|

|

|

|

|

|

|

|

How to Use the BRRRR Method

Let’s take a closer look at the BRRRR, meaning going through it step-by-step. While the process is relatively simple in theory, finding the right property, renovating, financing, and managing a rental can be challenging—even for experienced real estate professionals. Let’s dig into each part.

1. Buy

For the BRRRR method to be profitable, you have to find the right undervalued property. Look for homes you can do low-cost improvements on to increase their value, which will increase your equity in step 4. The more discounted a home you can secure, the more equity you’ll have at this step in the process.

Also, look for properties likely to rent out easily and quickly. For example, condos or apartments near a university will be in high demand. Once you’ve found an undervalued property, it’s time to consider the best option for financing. The typical finance options for the BRRRR method are as follows:

- Hard money loans: These loans are typically short-term and come from a private, non-bank lender. The application process for hard money lenders differs from a typical mortgage; the lender will prioritize the property’s investment potential over your credit. Interest rates are generally much higher than a typical mortgage, generally between 10% and 18%.

- Cash: This means that you would not use any financing and would simply pay for the property entirely in cash.

Rule of 70%

A smart investment rule of thumb is the Rule of 70%. This rule says you should only spend 70% of the property’s after-repair value (ARV) minus repair expenses. For example, if you’re looking at a $400,000 investment property that requires $80,000 of repairs and renovations, you shouldn’t spend more than $200,000 on it. Ideally, the remaining 30% can be used on closing costs and realtor commissions while still leaving a healthy profit leftover.

The formula for the 70% rule looks like this:

70% of the ARV – estimated repair costs = Maximum price for the property

2. Rehab

The rehab or renovation part of the process is the part that requires the most elbow grease—but not necessarily your own! Focus on renovations and repairs with the lowest costs that will make the property attractive to tenants. You should know how much you have to spend on repairs after purchasing the home.

The rehab process has three main parts:

- Finding a trustworthy contractor: You’ll need a professional contractor with experience with the types of repairs and renovations you need. Ask other investors and realtors for their recommendations, and then build a relationship with a contractor you can (hopefully) use again.

- Staying on schedule and on budget: Renovations always take time and money. Plus, the longer a renovation takes, the higher your carrying costs. Keeping your project on track is possible, but it takes plenty of work.

- Maximizing your ROI: Make sure you choose the renovations that will have the best ROI and set the property up for long-term success.

3. Rent

If you were doing a fix-and-flip, this is the time you would sell the home. However, with the BRRRR method, this is when you turn your property into a cash-generating asset by finding tenants and renting it out.

You will have to move relatively quickly here because, at this point, your expenses will likely be chewing a hole in your wallet. Make sure you analyze your cash flow thoroughly as you price your new rental. You could hire a property management company to market your property and screen renters, or you can do it yourself with the sales, finance, and communication skills you’ve learned as a real estate agent.

4. Refinance

After your property has been refurbished and leased, do a cash-out refinance to turn the equity in the house into cash. This moment is when the BRRRR method literally proves its worth in profits! Not only does this save you money, but cash-out refinances also have a lower interest rate than a home equity loan or line of credit (HELOC). Plus, you can deduct the interest from your taxes.

5. Repeat

If you want to build a real estate investment portfolio, you can use the money from the refinance as a down payment on your next BRRRR property. This time, you’ll have more expertise, a growing network of contractors, and a cash-generating rental property under your belt. You might even use the BRRRR method to create a large rental portfolio. By choosing smart properties and the right renovations, the sky’s the limit.

Frequently Asked Questions (FAQs)

What is the 70% rule for BRRRR?

The rule of 70% is a general real estate investing concept that helps you maximize profits. It says you should only buy an investment property for 70% of its after-return value (ARV) minus any repair expenses. For example, for a home that needs $40,000 in work and has an ARV of $350,000, the maximum you should spend is $205,000.

What are the disadvantages of BRRRR?

The biggest disadvantage of the BRRR investing strategy is that you need a very specific type of property to take advantage of this method. In a competitive market, it’s easier said than done to find an undervalued property that doesn’t need six figures of renovations. Plus, finding a hard money loan can be difficult.

Is the BRRRR method worth it?

The BRRRR strategy can work exceptionally well, but there are a few challenges. If you purchase a property that is too expensive, the rent payments may not cover your costs. In addition, if you don’t do a thorough inspection, you may spend too much on the renovation and get less than planned out of the refinance. However, if you take each step carefully, the BRRRR real estate method can be one of the best ways to build an investment portfolio quickly.

Bringing It All Together

The BRRRR method is an excellent real estate investing strategy that can help agents become investors, build equity, and scale their investment portfolios quickly. However, it takes a lot of time, research, and effort to do it successfully. Make sure you thoroughly research and plan each step of the process using our guide to be successful. Good luck!

The post What Is the BRRRR Method & How Does It Work in Real Estate? appeared first on The Close.

18 Jul, 2024 | Admin | No Comments

Predictive Analytics in Real Estate: Best Practices & Software for Agents

Imagine knowing exactly which homeowners in your area will sell their property in the next 12 months. It used to take a mind reader (or a lot of luck) to get that kind of inside intel on your local real estate market, but now it’s achievable with big data and the right predictive analytics company.

You need to embrace this technology and use it to help more clients (and help your pockets grow, too)! I will break down what predictive analytics in real estate are, how you can use them, their benefits, and which real estate analytics software you can use to boost your business. Here we go!

What Is Predictive Analytics in Real Estate?

Predictive analysis is a technique that uses data, statistical algorithms, and machine learning to identify the likelihood of future outcomes based on historical data. It involves analyzing current and past information to predict future events.

In real estate, predictive analysis can help agents forecast market trends, identify potential buyers and sellers, set competitive prices, and make strategic business decisions. These real estate analytics companies pull together millions (if not billions) of data points from multiple sources to give you important insights.

Common data sources include the following:

- Property

- Demographics

- Behavioral trends

- Event data (user-generated activity data from products, software, or websites)

Why Predictive Analytics Matters in Real Estate

If you’re a MARVEL fan, you may remember in Captain America: The Winter Soldier the scene where Jasper Sitwell gets kicked off the roof by Black Widow for information about Zola’s algorithm. Ok, we won’t be kicking anyone off any rooftops, but Zola’s algorithm is a great example of predictive analysis. It provided data on who to target, when to target them, and how to take them down.

The same concept is applied to PA in real estate. Imagine if you had a list of homeowners in your farm area who were identified via predictive analytics as highly likely to sell their homes in the next 12 to 18 months. Think of the time, energy, and money you could save by marketing specifically to those homeowners. You can make it work for you in your real estate business with a company that knows how to harness it.

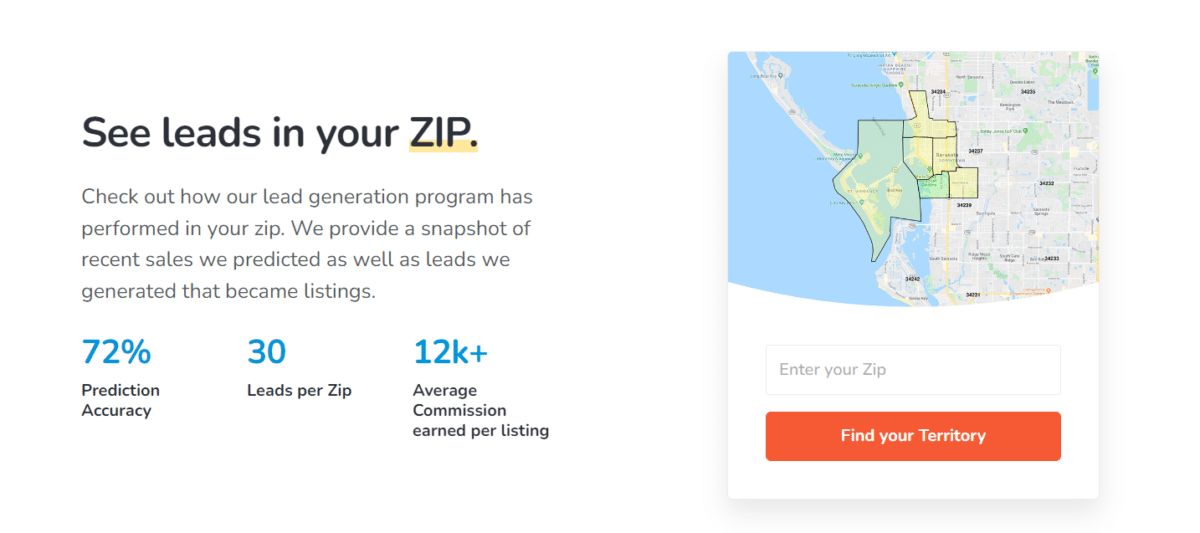

Ok, let me give you some actual data to consider. One of our top picks, Offrs, provides 30 guaranteed leads in a chosen ZIP code every month, and those leads come with an astounding 72% prediction accuracy rate. Assuming that prediction rate, you’d have about 20 solid leads each month. The average listing commission is over $12,000. So, if you convert half of your leads, that’s $120,000. As Offrs says: It’s not magic; it’s math.

Benefits of Using Predictive Analytics for Real Estate

Real estate predictive analytics is changing the game, giving agents and brokers powerful tools to understand market trends and customer behaviors. With tons of data and smart algorithms, this tech helps you make better decisions, market more effectively, and stay ahead of the competition.

Using predictive analytics in real estate offers several key benefits:

- Accurate market predictions: Helps agents predict market trends, including which properties are likely to sell and when.

- Targeted marketing: Allows more accurate marketing efforts by identifying potential buyers and sellers, leading to better conversion rates.

- Improved pricing strategies: Assists in setting competitive sales prices based on data-driven insights rather than gut feelings.

- Enhanced customer insights: Provides a better understanding of customer preferences and behaviors, allowing you to personalize your services.

- Competitive advantage: Gives agents an edge over competitors who may not use predictive analytics.

- Increased sales: Ultimately leads to higher sales and revenue through more effective and targeted business strategies.

How Agents Can Use Predictive Analytics

Now that you know what PA is, why it’s important, and what the benefits are, it’s time to put predictive analysis to work for your business. While residential real estate analytics isn’t fully on par with the commercial side yet, we’re getting closer to seeing every agent, team, and broker using AI or data analytics tools in 2024.

Here are a few ways you can start to incorporate PA into your business practices:

The Best Predictive Analytics Companies in 2024

Wondering which companies are at the forefront of predictive analytics in real estate? These companies are transforming how agents predict market trends and make informed decisions. If you’re considering integrating predictive analytics into your real estate strategy, here are some top recommendations for real estate data analytics companies that are reshaping how agents predict market trends, identify potential clients, and optimize their business strategies.

Take a look at some of the top players in the game.

| Company | Best For | Starting Monthly Prices | Read Our Review |

|---|---|---|---|

| Smartzip | Seller leads | $299 | Smartzip Review |

| Offrs | Seller leads + marketing | $300 | Offrs Review |

| Catalyze AI | Leads related to inherited property | $360 | No review yet |

| Top Producer | All-in-one lead generation and CRM solution | $399 | Top Producer Review |

1. Smartzip: Best for Sellers Leads

|

|

|---|---|

|

Pros |

Starting Monthly Prices

|

|

Cons |

|

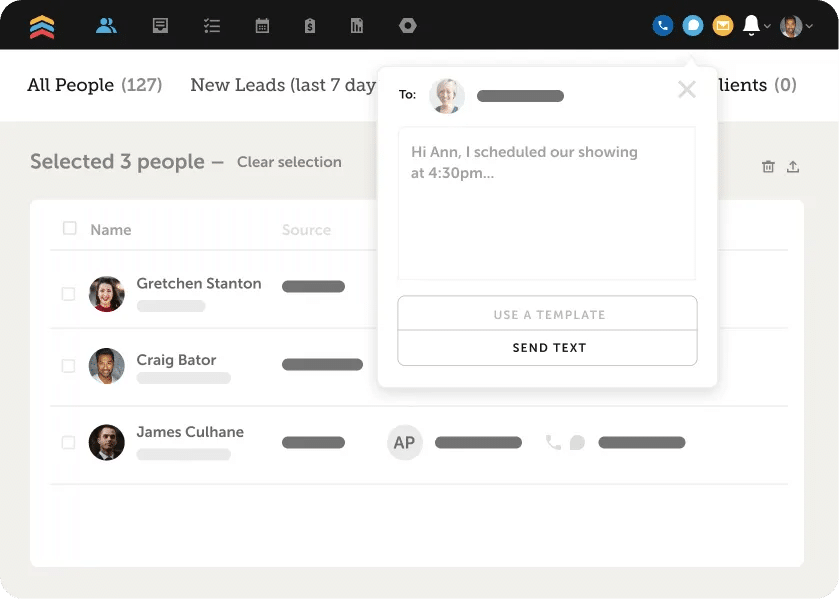

By combing through consumer data (from places like credit card companies), market data (from places like your MLS), and demographic data, Smartzip predicts which homeowners in your targeted region are most likely to sell. Realtors who sign up with Smartzip immediately get access to the Smartzip CRM, populated with “Smart Data” for their areas.

Essentially, this is a list of all the property owners in your targeted area, ranked by how likely they are to sell their home in the next year and a half. Armed with this information, you can focus your outreach on only the most likely sellers, saving you time and money on marketing efforts and making your lead conversations more meaningful and fruitful.

Smartzip: Is It Right for You?

If you’re already investing heavily in real estate farming and seller lead nurturing, Smartzip is an excellent real estate predictive analytics tool for you. Since leads from Smartzip tend to take a little longer to nurture than traditional listing leads, you will need a solid keep-in-touch strategy. If you’ve got a good lead nurturing game in place, Smartzip is absolutely worth considering.

2. Offrs

|

|

|---|---|

|

Pros |

Starting Monthly Prices

|

|

Cons |

|

While Offrs is owned by the same company as Smartzip, the actual product is very different. Both are built on the same Smart Data platform, but Offrs customers also have access to sophisticated and automated marketing and nurturing tools.

Plus, the Offrs Roof referral system is an added bonus. For a 25% referral fee, Offrs’ call center and email marketing team will initiate at least 30 touches in the first 90 days, starting immediately when a lead comes through. This makes the nurturing process even less of a lift, especially since about 67% of clients go with the first agent they speak with.

Offrs: Is It Right for You?

If you need automated marketing services, this is a platform you should absolutely consider. If you don’t need the more specialized lead types or automated marketing features, you’re probably better off going with Smartzip, with its upgraded CRM and user interface.

3. Catalyze AI

|

Pros |

Starting Monthly Prices

|

|

Cons |

|

Every year, hundreds of thousands of properties are inherited. Catalyze AI helps sort through all of the data points (over 400 million of them) to narrow these properties down to excellent leads. It is so excellent that it boasts that four out of 10 predicted leads sell within 12 months. Catalyze AI estimates this market represents $77 billion in property value each year.

I like that Catalyze AI offers leads within a 20-mile radius of your search area and that you can pay based on the value of the property: one monthly rate for properties valued above $1 million and one for below. And finally, and perhaps most importantly, these leads are exclusive, which makes them pretty darn valuable.

Catalyze AI: Is It Right for You?

Inherited property leads are fairly niche, and it takes someone with strong interpersonal skills to convert them, especially if the new property owner is recently bereft. It will also take patience and strong follow-up. That being said, this is a really strong market, and the leads are local, not outrageously expensive, highly probable to convert, and exclusive. Because it’s month-to-month, it’s definitely worth checking out Catalyze AI; it’s a company in the PA space that we’re excited to watch.

4. Top Producer

|

Pros |

Starting Monthly Prices

|

|

Cons |

|

While Top Producer’s predictive analytics product, called Smart Targeting, isn’t far from what other PA companies are doing (in fact, its data is supplied by the same company as Offrs and Smartzip), it is unique to have the analytics as part of a larger lead generation and tracking ecosystem. There are some real advantages to having everything working together in the same place. If you’re using Top Producer, one of our favorite CRMs in the industry, to prioritize, track, nurture, and convert leads fed to your funnel by predictive analytics, you’re cooking with gas, as they say.

Top Producer’s biggest value is in its CRM, which allows a busy agent to rely on automatic follow-up with leads. It’s not cheap—in fact, it’s hard to tell exactly what Smart Targeting costs as it’s an add-on to the base price—but it is an exciting development in the industry. Synergy between all of your sales and marketing is a beautiful thing.

Top Producer: Is It Right for You?

If you already have a CRM that you love, Top Producer isn’t for you. You’re better off subscribing to Offrs or Smartzip and integrating it into your existing CRM. It’s only if you’re already using Top Producer or you want to make a CRM change that you should consider jumping in with two feet. Real magic can happen when all of your systems are not only talking to each other and working together, but also taking advantage of cutting-edge technology that can skyrocket your business.

Are you a lender or homeowner interested in hearing about other great predictive analytics tools that are easy on the wallet? Check out our review of Homebot to kick off your search.

Methodology: How I Chose the Best Predictive Analytics Companies

Our methodology at The Close ensures that our team of professionals, writers, and editors thoroughly analyzes each platform. We meticulously evaluate the features, usability, integration capabilities, performance, and affordability of the AI tools available for real estate.

Even though our team has decades of combined real estate experience, navigating through the wild, complex, and sometimes confounding world of data analytics wasn’t easy. To make sure we were using objective measures, in addition to our educated opinions, we looked at these five key criteria to select our picks for the top companies:

- Affordability and value for money: Cost was an important consideration. We looked for tools that provided a good balance of features and return on investment.

- Feature set and functionality: We evaluated the range of features each tool offers and focused on how impactful these features are to real estate operations.

- Usability and customer ratings: We looked for tools with intuitive interfaces, straightforward navigation, and comprehensive support resources. We want to ensure it can be easily integrated into an agent’s workflow.

- Integration capabilities: Because so many tools are needed in the real estate industry, we want to ensure that an agent’s technology stack can communicate with other tools necessary for business.

- Effectiveness and performance: We considered the effectiveness of each tool to make sure that it increased productivity and would achieve the desired outcomes that it promised.

Frequently Asked Questions (FAQS)

What are the challenges of using predictive analysis in real estate?

Using predictive analysis in real estate can be tricky. Data quality and availability often need to be more consistent, making it hard to get accurate predictions. Market conditions can be volatile, influenced by economic factors and unexpected events like natural disasters. Models can sometimes be overly complex or too closely tied to past data, reducing future accuracy.

The tech side of things also presents hurdles, from needing complex equations to finding the right algorithms. On top of that, human factors like expertise and bias can impact results. Let’s also not forget any legal and ethical considerations like privacy, which must be considered. Real estate agents are also resistant to change. Combine that with the higher cost of obtaining these analytics, and it can be a difficult sell to a broader audience.

What problem is being addressed by applying predictive analytics to real estate?

Applying predictive analytics to real estate helps take the uncertainty out of marketing. It is aimed at providing more accurate property valuations, predicting market trends, and spotting investment opportunities. This helps everyone involved—buyers, sellers, investors, and real estate pros—make smarter decisions, cut down on marketing risks, and boost profits.

How do predictive analytics impact the real estate industry?

Predictive analytics have a big impact on the real estate industry by making it more efficient and data-driven. They help with pricing properties more accurately, spotting market trends early, and finding the best investment opportunities. This means buyers, sellers, and investors can make smarter choices and cut down on risks. For real estate agents, predictive analytics make things run smoother, improve marketing, and boost overall efficiency. Basically, they take a lot of the guesswork out, leading to better results for everyone in the market.

Bringing It All Together

Data analytics, and predictive analytics specifically, is an exciting, cutting-edge field that has the potential to completely shake up our industry. I believe that agents, teams, and brokers will see a serious ROI with the right data analytics tool. I hope this guide has helped narrow down the options and decide what might be the right company (or companies) for your business.

Are there any predictive analytics companies serving the real estate world that we missed? Who should we include the next time around? Tell us in the comments below!

The post Predictive Analytics in Real Estate: Best Practices & Software for Agents appeared first on The Close.

Are you tired of the monthly rent chase? Say goodbye to this stress with the convenience of online rent payment services! These services are designed to be user-friendly and allow you to track rent payments and automate rent collection easily. Check out this list of best online rent payment services for landlords, and never stress about rent collection again.

- Baselane: Best for the free subscription and accounting tools

- Hemlane: Best for an all-in-one solution and intuitive interface

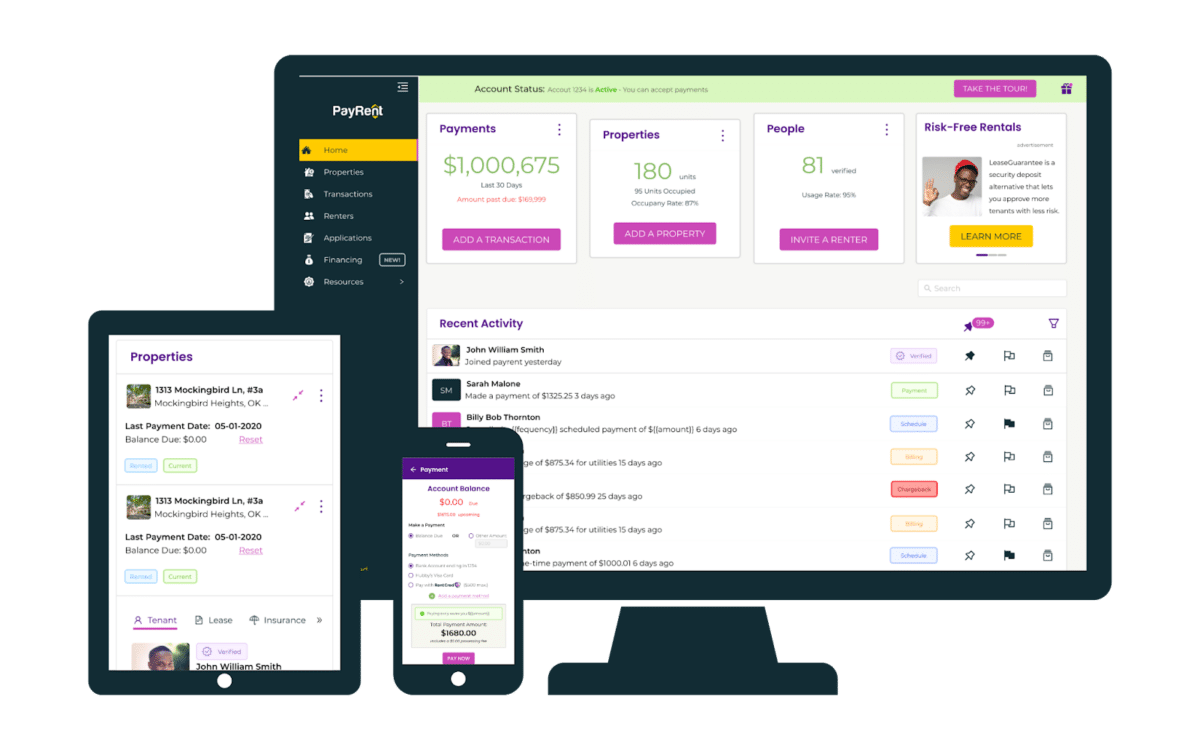

- PayRent: Best for secured online rent collection

- TenantCloud: Best for mobile app

- Avail: Best for next-day rent payment feature

The Close’s Top Picks for Best Online Rent Payment Services

| Online Rent Payment Software | Best for | Starting Monthly Price | Learn More |

|---|---|---|---|

| Free subscription and accounting tools | Free | Visit Baselane | |

|

All-in-one solution and intuitive interface | Free | Visit Hemlane |

|

Secured rent collection | Free | Visit PayRent |

| Mobile app | $15.60 (billed annually) |

Visit TenantCloud | |

| Next-day rent payment | $0 per unit | Visit Avail |

| Online Rent Payment Software | Best for | Starting Monthly Price | Learn More |

|---|---|---|---|

| Free subscription and accounting tools | Free | Visit Baselane | |

|

All-in-one solution and intuitive interface | Free | Visit Hemlane |

|

Secured rent collection | Free | Visit PayRent |

| Mobile app | $15.60 (billed annually) |

Visit TenantCloud | |

| Next-day rent payment | $0 per unit | Visit Avail |

Baselane: Best for Free Subscription & Accounting Tools

Why I Chose Baselane

-

Baselane Pricing:

Free for banking, online rent collection, and bookkeeping

Baselane ranked first as the best online rent payment service for its free subscription with no monthly fees or minimum balances. Not only does it send automated payment reminders to tenants, but it also deposits payments directly into your bank account within 2 to 5 days. I also love that tenants can pay rent on any device through ACH bank transfer or debit or credit card and easily enroll in auto-pay. On top of that, Baselane provides real-time cash flow, performance tracking, and auto-generated financial and tax reports.

Additional Features

- Baselane checkbooks: Order checkbooks directly for any Baselane checking account, eliminating the need for third-party providers. Each order includes 80 high-security checks.

- Create and e-sign lease agreements: Baselane and Rocket Lawyer team up so you can easily make, save, and sign lease agreements in Baselane. You can also invite others to sign.

- Send checks online: Securely pay vendors and bills from your Baselane checking account by sending checks directly. Just enter the payment amount, recipient’s name, and address, and Baselane will print and mail the check for you.

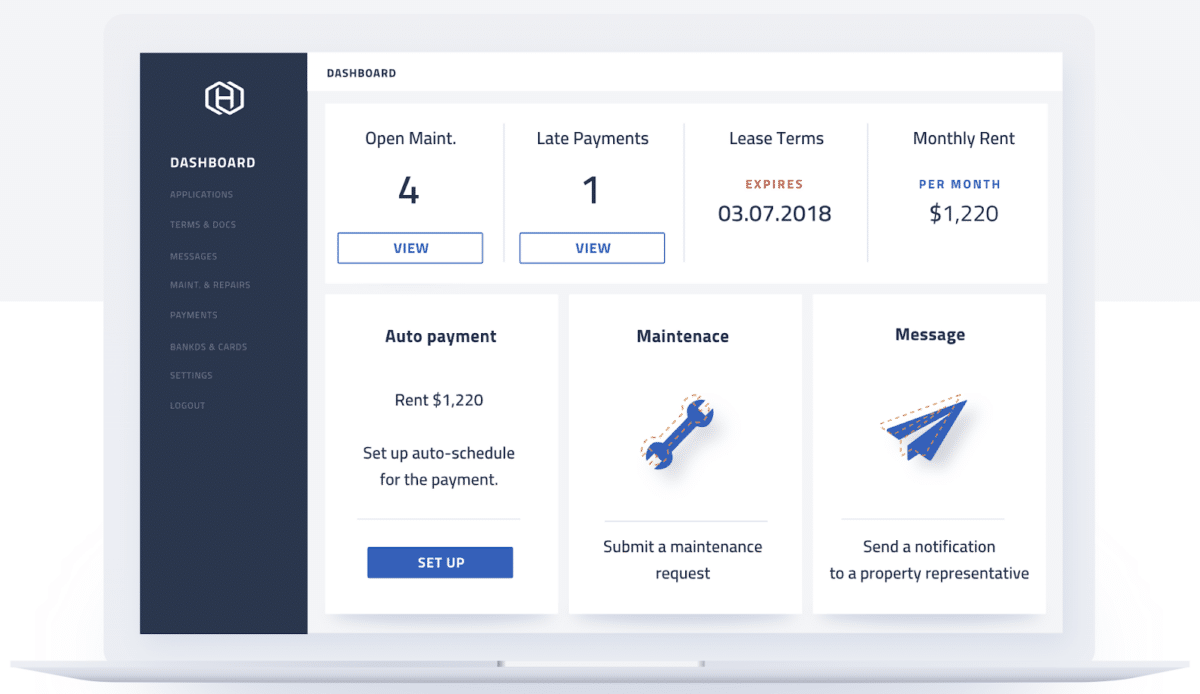

Hemlane: Best for All-in-One Solution & Intuitive Interface

Why I Chose Hemlane

-

Hemlane Monthly Pricing (based on annual billing, monthly billing available at higher rate):

- Free Forever

- Basic: $30

- Essential: $48

- Complete: $96

Hemlane provides a one-stop solution, including online rent collection service, maintenance coordination, tenant screening, and financial reporting. With its easy-to-use interface and flexible pricing, including a free plan, Hemlane is ideal for landlords prioritizing efficiency and peace of mind. What’s more, Hemlane enables online rent payments through ACH and credit cards, ensuring timely payments with automated reminders and late fees. Landlords receive payments directly deposited into their accounts without any deductions.

Additional Features

- Maintenance Coordination: The platform has a 24/7 service for managing maintenance requests. Hemlane’s team handles tenant repair requests, works with preferred service professionals, and ensures clear communication and timely solutions.

- Financial Reporting: It helps landlords track income and expenses and generate detailed financial reports. It also integrates with accounting software for seamless financial management.

- Marketing and Listing: Hemlane promotes rental properties on popular listing websites like Zillow, Trulia, Hotpads, and Zumper. This increases property visibility and helps attract potential tenants.

- Tenant Screening: Hemlane thoroughly screens potential tenants, including background checks, credit reports, and eviction history. This helps landlords choose reliable tenants.

PayRent: Best for Secured Online Rent Collection

Why I Chose PayRent

-

PayRent Monthly Pricing:

- Pay-As-You-Go: $0

- Do-It-Yourself: $19 (try free for 7 days)

- Go-Like-A-Pro: $49 (try free for 14 days)

Keep your transactions secure with PayRent’s safe payment methods. Easily accept credit cards or bank transfers from any US-based bank or credit union without having to share your personal information with your tenants. With RentDefense , effortlessly collect rent while enjoying exclusive payment controls and protections. Plus, the platform offers convenient features like recurring payment options and direct deposit into your bank account, ensuring that you receive timely and reliable rent payments.

, effortlessly collect rent while enjoying exclusive payment controls and protections. Plus, the platform offers convenient features like recurring payment options and direct deposit into your bank account, ensuring that you receive timely and reliable rent payments.

Additional Features

- Account balance tracking: Renters can easily check their account status using PayRent’s online rent payment services. They can see how much they owe, upcoming charges, and payments. Landlords and renters can access these digital records to ensure agreement about the account status.

- Split payments: Tenants can divide their rent payments between multiple payment methods.

- Tenant applications and screening: Landlords can get critical information about potential renters and their backgrounds through one of our in-app application partners. This includes personal and household details, employment and income, residential history and background, credit score, criminal history, and evictions.

TenantCloud: Best for Mobile App

Why I Chose TenantCloud

-

TenantCloud Monthly Pricing (based on annual billing, monthly billing available at higher rate):

- Starter: $15.60

- Growth: $29.30

- Pro: $50.40

- Business: Contact for pricing

Check out the TenantCloud mobile app for iOS and Android—it’s completely free! With this app, efficiently manage your dashboard, team, rent collection, and tenant screenings without constantly logging in and out of your account. TenantCloud makes it easy for landlords and tenants to manage rent payments online. It offers direct bank transfers, ACH payments, credit/debit card options, and payment tracking. I also love that tenants can set up Auto Pay, and landlords can customize payment settings, late fees, and payment allowances.

Additional Features

- Rental accounting: Store, organize, find, and summarize financial information. You can easily track property transactions and balances, schedule invoices, late fees, and receipts, apply deposits, refunds, and discounts, and export all your account data to a ZIP file.

- Financial reports: Landlords can use Schedule E and other tax reports to manage their taxes. They can also generate and send 1099 tax forms to recipients digitally through their accounts. Additionally, they can synchronize income and expense transactions with QuickBooks for better task management.

- Rental applications: Tenant applicants can send their applications to your TenantCloud account. Then, you’ll review and approve the applications. Modify the application form to ask about basic things like living and work history, income, and references. You can also ask for an application fee and check their background and credit to make the process faster.

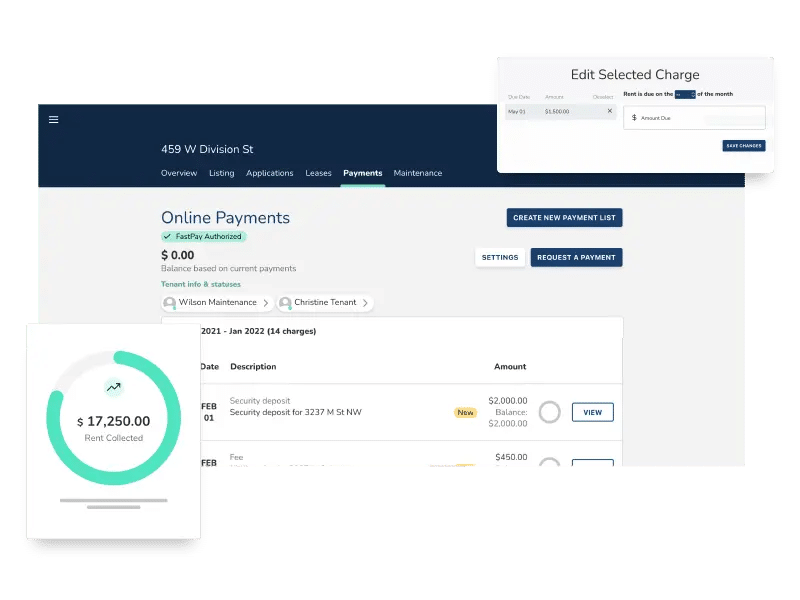

Avail: Best for Next-day Rent Payments

Why I Chose Avail

-

Avail Monthly Pricing:

- Unlimited: $0 per unit

- Unlimited Plus: $9 per unit

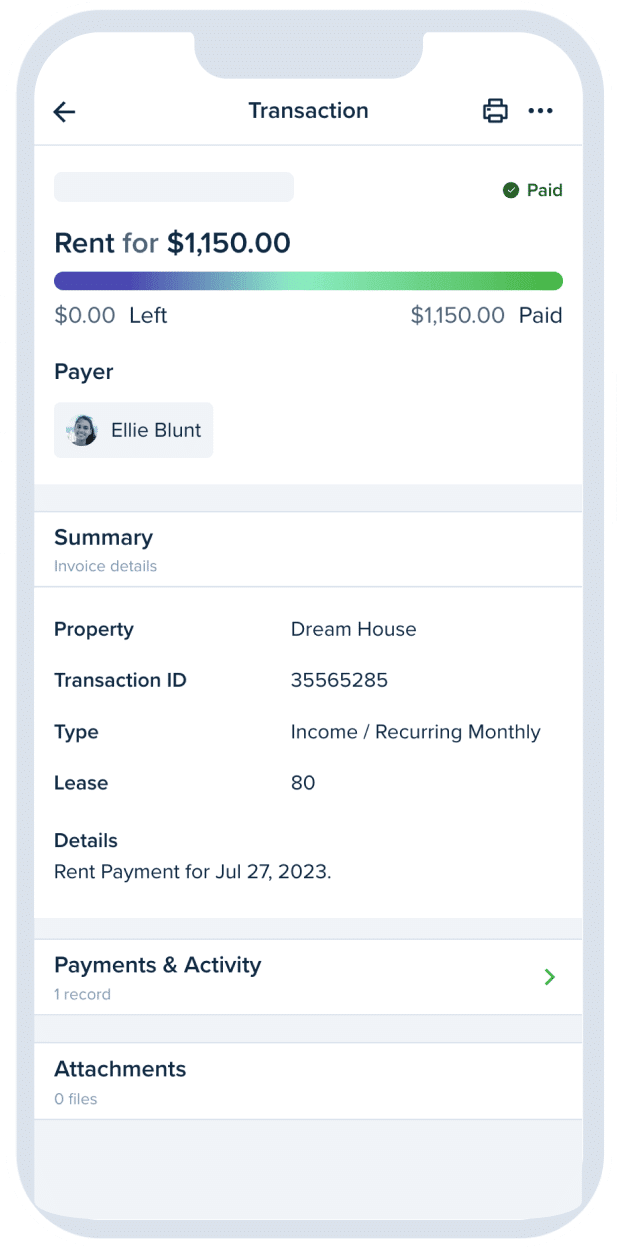

Experience the convenience of Avail FastPay, where landlords can receive funds as quickly as the next business day. With Avail’s online rent payment services, you’ll enjoy specialized deposit and fee collection, automatically generated payment receipts and confirmations, and seamless setup for recurring payments. Landlords can also set up rent reminders and notifications, auto-assess late fees (one-time or recurring), and allow rental payments to be reported to credit bureaus with CreditBoost.

Additional Features

- Property accounting: This feature allows landlords to track their finances accurately. Landlords can see how much money their rental properties make and their running costs. Avail’s system will automatically populate your dashboard with payments and maintenance expenses.

- Maintenance tracking: Avail’s maintenance tracking feature includes instant messaging for tenant communication in the app and automatic email notifications for landlords or contractors when maintenance requests are submitted. It also provides status updates on maintenance tickets and allows landlords to add expense details for better financial organization.

- Leasing agreements and online signatures: Avail offers state-specific lease agreement templates that comply with landlord-tenant laws. The system converts your preferences into a binding contract and allows for digital signatures from tenants. Other features include locally generated clauses, unlimited document attachments, and print and PDF lease generation.

Methodology: How I Chose the Best Online Rent Payment Services

I evaluated the best online rent payment services by using a weighted rubric created by our team of licensed real estate professionals, writers, and editors. Our team spent hours researching dozens of companies and assessing each based on the most impactful elements for landlords, tenants, and property managers. Here are the criteria we used for our evaluations.

- Pricing (25%)

- I looked at the average price per unit or month for subscription plans and if the software offers a free trial.

- General Features (10%)

- I evaluated each company’s main features, like rental listing management, rental applications, applicant screening, generating leases, maintenance requests, and tenant portal.

- Advanced Features (30%)

- I assessed whether the platforms offer direct deposit, autopay, free ACH, collection of security deposits and pet fees, and accept payments via debit/credit card or bank account. I also evaluated if each software features automated payment reminders, automated late fees, and the ability to accept partial payments. Additionally, I checked if each platform has payments available the next business day, payment tracking and reporting, and personal vs. business expense tracking.

- Ease of Use (10%)

- It is based on how easy it is to navigate the provider interface and whether it provides hassle-free transactions and communication between property owners and tenants. It also considers if the platform offers a mobile app, third-party integrations, and an automated system.

- Help & Support (10%)

- We looked into the convenience and attainability of customer service for technical and customer support.

- Customer Rating (10%)

- I read software reviews after taking it for a test drive to evaluate others’ experiences compared to my own. I take that additional feedback into account when assessing any software.

- Expert Score (10%)

- I give extra credit for any standout features not covered in the above categories.

Your Take

Online rent payment services offer landlords the tools for seamless rent collection. With secure online payments, automatic reminders, and detailed reporting, landlords can improve their rental management experience. It’s time to take the hassle out of rent collection and elevate your landlord game.

Share your thoughts in the comments section—let’s make rent collection a breeze!

The post 5 Best Online Rent Payment Services for 2024 appeared first on The Close.

Real estate teams can offer numerous advantages for agents, from increased support and resources to the potential for higher earnings. Additionally, building a successful real estate team involves careful planning and execution. In this introduction, we’ll explore the benefits of real estate teams for agents and outline a 7-step process on how to build a real estate team while highlighting the mistakes to avoid along the way. Let’s dive in and uncover the valuable insights that can help you thrive in the real estate industry.

What Is a Real Estate Team?

Before I get into how to build a real estate team, you need to know what a team is all about. A real estate team is a group of agents and employees with complementary skill sets that join to close more deals.

Teams come in all shapes and sizes—ranging from a duo of experienced agents who work side by side to close deals together to a single licensed agent with multiple unlicensed assistants to a dozen or more buyer’s agents, listing agents, and inside sales associates. How you structure your team is entirely up to you and depends on your business needs. However, you need to review the pros and cons to decide if it’s right for you.

|

Pros

|

Cons

|

|---|---|

|

|

|

|

|

|

|

|

Steps of How to Build a Real Estate Team

Now that you know what a real estate team is and its advantages and disadvantages, it’s time to learn how to put it together. Before starting your quest to dominate your real estate market with a team, you need a plan. Here are the step-by-step instructions on how to build a real estate team and run it successfully.

Step 1: Get Approval & Guidance From Your Managing Broker

Even though real estate teams are legal in all 50 states, you must still talk to your broker to ensure you know the rules on how to start a real estate team. You’ll also need a split and cap agreement to know how much money you can count on from each transaction to pay your team and cover your expenses. You can renegotiate with your broker as your team grows and becomes more successful.

Why Managing Brokers Love Teams

Are you worried about whether your managing broker will approve your team? Don’t be. Leadership typically encourages agents to start teams. Why? Teams require less hands-on management and usually recruit and train junior agents independently. This means less work for your boss, not more. Also, if you come to your broker with a detailed plan for your team, they’re more likely to take you seriously and offer help getting your team off the ground.

Step 2: Choose the Right Team Structure

Once you get the green light from your managing broker, the next step is to decide how your team will be structured. Here is a quick overview of our three favorite team structures to get you started.

If you love training new agents and work at a brokerage that offers revenue sharing, the mentor-mentee model might be your best bet. In this model, team leaders recruit, train, and mentor new agents to generate their own leads. Unlike other structures, agent retention is not the goal here. Instead, you mentor them until they are ready to build your downline. Since you won’t have to reach into your pocket to generate leads for your agents, costs are low, which means better splits and less work recruiting new agents.

Drawbacks of the Mentor-Mentee Model

- Time-consuming: You will spend almost all your time recruiting and training new agents.

- Constant recruitment: If you’re not a skilled recruiter or dislike having a new face in your office every other month, this model might not suit you.

To build a strong personal brand and use it as the main focus of your team, consider the team leader model. This model functions like a unique real estate group, with the team leader’s brand as the focal point instead of a group brand. As the team leader, you’ll be the primary agent for listing properties and bring in other listing agents, showing agents, and support staff to help your business.

Drawbacks of the Team Leader Model

- More expensive: Requires support staff, making it more costly to start and run.

- Personal brand reliant: Since your brand drives this model, it won’t work well unless you have a solid brand and an established reputation in your farm area.

If you have the cash to burn, a strong business background, and thrive on organization and systems, the lead team model is for you. You’ll operate more like a startup’s founder than a real estate agent team leader. Instead of generating leads for everyone else, a business manager oversees a marketing manager, and a team of inside sales agents fills your customer relationship manager (CRM) with fresh leads. Those leads are then fed to listing agents and showing agents, who close them with the help of a transaction coordinator.

Drawbacks of the Lead Team Model

- Can be expensive: Requires significant financial investment.

- Employee salaries: These must be paid regardless of market conditions.

- Capital: Not suitable for businesses without sufficient capital to withstand economic downturns.

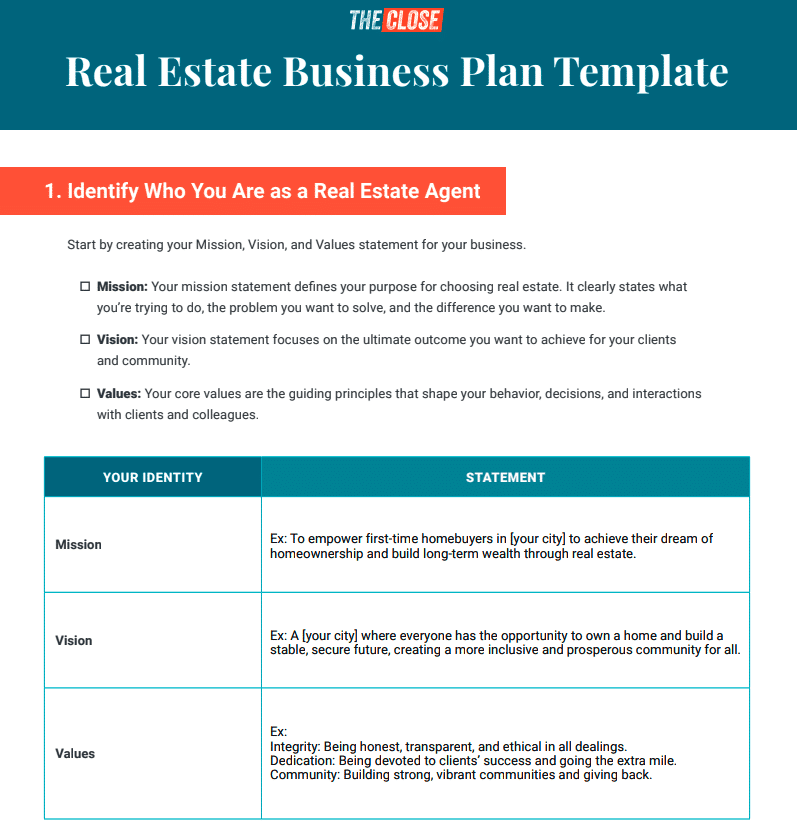

Step 3: Develop a Business Plan & Budget

When overseeing a real estate team’s operations, it’s essential to recognize the unique aspects compared to managing a solo real estate business. A comprehensive real estate business plan outlining your requirements, financial considerations, and strategies for utilizing the generated revenue is crucial for success.

The real estate team business plan must include the following items:

- Mission, vision, and values

- Detailed overview of the team’s organizational structure

- Roles and responsibilities of team members

- Strategies for effective team communication and collaboration

- Conducting a SWOT analysis and setting SMART goals

- Lead generation and client conversion strategies tailored to a team-based approach

- Client relationship management and nurturing strategies

- Comprehensive marketing plan for both team and individual agent branding

- Scalability plans include expanding, hiring, and training new team members

- Financial plan reflecting revenue-sharing model, budget allocations, and profit-sharing arrangements

Step 4: Decide on a Compensation Model

When working in real estate teams, the commission is usually split among team members. Junior agents typically receive 40% to 50%, and team leaders get 60% to 75%. Teams often have a cap of around 90% of the collective cap of a group of licensed agents of the same size. It’s important to be generous when attracting high-quality agents; adjustments can be made as your team grows.

Wondering how much you’ll take home after sealing the deal? Use our handy calculator to find out! Just provide the details below, and we’ll automatically calculate your commission.

- Sale price of home: The amount of money the buyer agrees to pay for the seller’s home.

- Percent of the commission collected by an agent from the sale: The percentage of the sale price you are collecting at the close of the transaction.

- Agent commission split with brokerage: Your commission rate is agreed upon between you and your brokerage.

label {

display: inline-block;

margin-bottom: 10px;

color: black;

width: 70%;

}

input[type=”number”] {

display: inline-block;

width: 15%;

border: none;

border-radius: 5px;

background-color: #f7f7f7;

padding: 10px;

margin-bottom: 10px;

margin-left: 20px;

}

button {

display: block;

margin: auto;

margin-top: 10px;

background-color: #EF5937;

color: black;

padding: 10px;

border: none;

border-radius: 5px;

cursor: pointer;

transition: background-color 0.3s;

}

button:hover {

background-color: ;

}

#result {

font-weight: bold;

margin-top: 25px;

background-color: #EF5937;

color: black;

text-align: center;

font-size: 20px;

}

#commission {

margin: 0 auto;

border-style: solid;

padding: 50px;

}

}

function calculate() {

var sales_price = document.getElementById(“sales_price”).value;

var commission_collected = document.getElementById(“commission_collected”).value / 100;

var broker_split = document.getElementById(“broker_split”).value / 100;

var commission_split = (sales_price * commission_collected) * broker_split;

document.getElementById(“result”).innerHTML = “Commission Split ” + “$” + commission_split.toFixed(2)

}

Equation 1: Sale Price of the Home X Percentage of Commission Collected by Agent from Sale = Total Commission Amount Before Splits

Example: $400,000 X 3% = $12,000

Equation 2: Agent Commission Split With Brokerage X Total Commission Amount Before Splits = Money for Agent

Example: 70% X $12,000 = $8,400

Equation 3: Money for Agent – Total Commission Amount Before Splits = Money for Brokerage

Example: $12,000 – $8,400 = $3,600

Step 5: Build Your Technology & Communications Stack

Remember, the tools you choose can significantly impact your team’s success. The right software helps attract new team members and reduces stress and confusion. I’ve selected some top team tools and software specifically designed to help teams. They will allow you to start with just two team members and add more as your team grows.

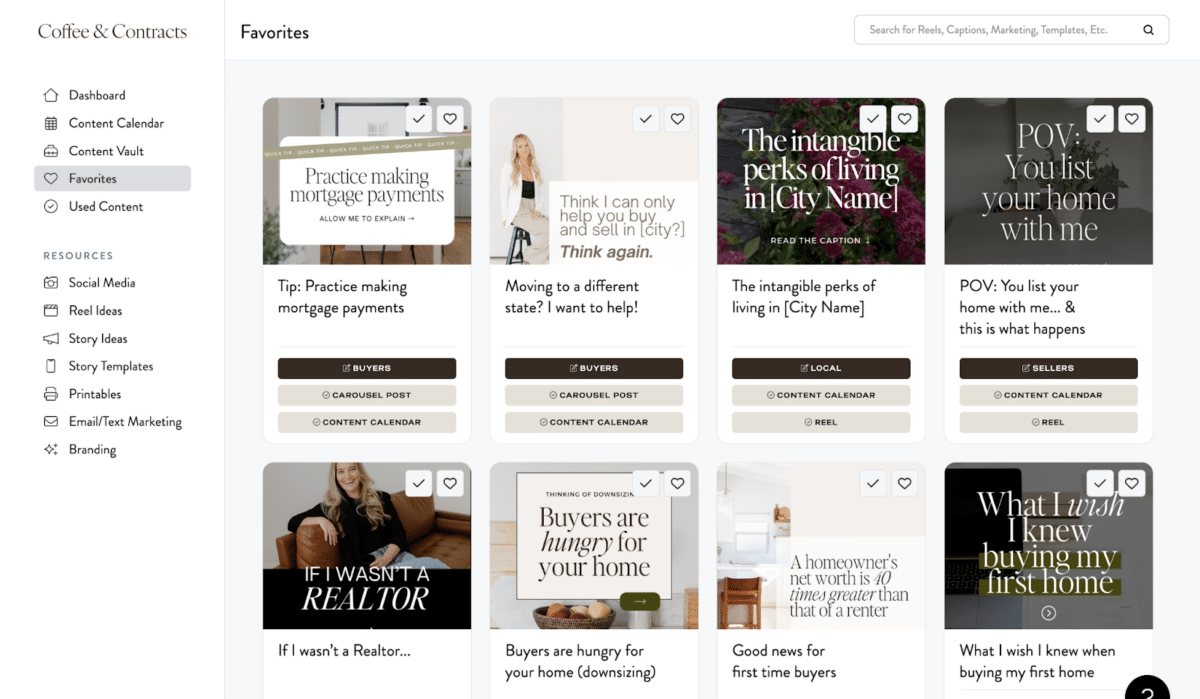

Marketing: Coffee & Contracts

Want to run the team leader model but can’t afford to hire a marketing manager? Coffee & Contracts is your new secret weapon. They offer beautifully designed social media and print templates that make everyone think you hired a $100,000-a-year marketing manager.

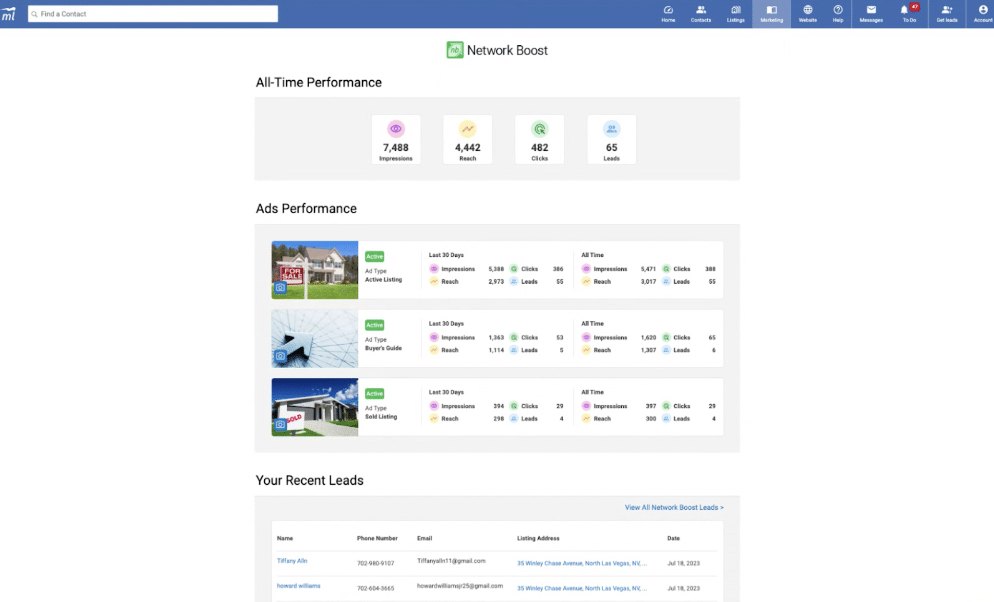

Lead Generation: Market Leader

If you need a steady stream of seller leads without the hassles of running your platform, then Market Leader is for you. Their exclusive seller leads come from housevalues.com, one of the internet’s most efficient lead capture websites. All you need to do is sign up and start qualifying your leads.

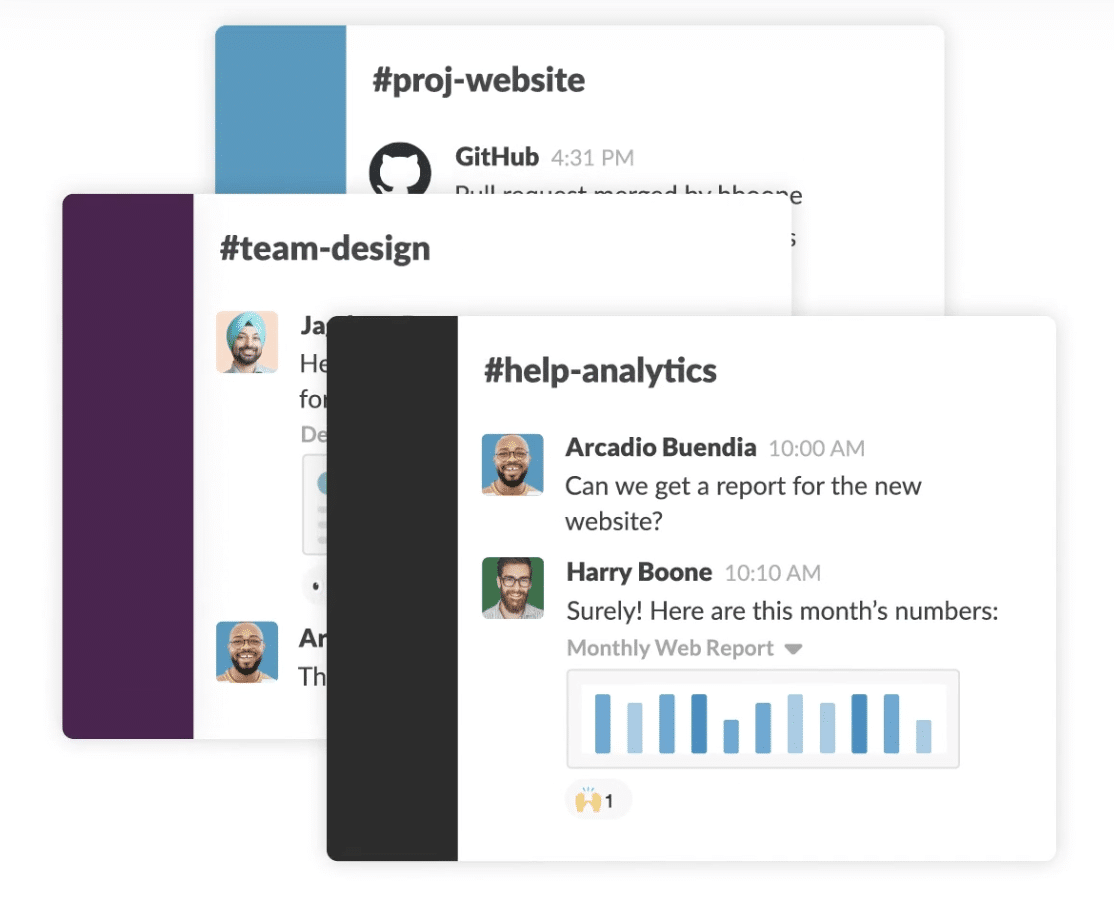

Communication: Slack

Want to escape the drudgery of digging through your inbox just to follow up on conversations with your team? Slack, a business group messaging platform, is the 21st-century method innovative teams use to communicate. No more lost emails or scrolling through endless email chains to find that one disclosure file.

Step 6: Hire an Administrative Assistant

If you want to set your team up for success, your first hire should be an administrative assistant. Having an administrative assistant on your team can be an attractive lure for recruiting junior agents. This person’s primary responsibility is to take work off the plate of the team leader or other licensed team members so that they can focus on the real estate-specific tasks that drive new client relationships and closed deals.

This work includes things like the following:

- Filing

- Calendar coordination and scheduling

- Communication that doesn’t include real estate-specific advice or strategy

- Light marketing tasks

- Errands

- Sign placement

- Marketing material delivery

- General office organization

The ideal candidate for this position is organized, helpful, and solutions-oriented. They see a problem that needs fixing or a chance to increase the efficiency of a daily routine and fix it without being told to. This role is generally entry-level, so real estate experience isn’t necessary here. But it is helpful, especially if you’re a top producer with a lot of volume.

Pro Tip

Pro Tip

If you’re short on cash or just want to maximize your ROI, consider hiring an overseas virtual administrative assistant. Since administrative work for real estate agents is a common need, you can easily find someone in the Philippines with direct experience working with real estate agents.

Step 7: Build Out the Rest of Your Team

Once your team starts closing more deals than your agents can handle, it’s time to scale and recruit for your team. While the team model you choose will determine who you should hire next, here is the general order we recommend for most teams.

| Team Member | Description | What to Look For |

|---|---|---|

|

Buyer’s Agent |

A licensed real estate professional who works exclusively with house hunters. When you reach the point where you have more buyers than you have time, a buyer’s agent is the right hire. |

|

|

Transaction Coordinator |

A transaction coordinator is a professional who helps with real estate sales. They work for real estate agents or property sellers to manage tasks and paperwork for closing deals. |

|

|

Listing Specialist |

A listing specialist is an agent who specializes in listing properties. As your business grows, you might need to add another listing agent to your team to handle the increasing listing presentation requests. |

|

|

Marketing Specialist |

A marketing specialist is responsible for envisioning, designing, and executing a marketing strategy for your real estate team. Their work includes branding, lead generation, referral generation, and property marketing. |

|

|

An inside sales agent’s primary responsibility is to create new leads through outbound communication, qualify incoming leads, and pass opportunities on to other team members for nurturing and closing. |

|

Critical Mistakes New Team Leaders Make

Now that you have a better idea of how to set your team up for success let’s examine some common missteps that bright-eyed and bushy-tailed new team leaders make and how to avoid them.

- Mistake #1: Not embracing the platinum rule: “Do unto others as you would have them do unto you.”

- Do this instead: Great leaders embrace the Platinum Rule, popularized by authors Michael O’Connor and Tony Alessandra: “Treat people how they want to be treated.” You must also commit to knowing your people well enough to understand exactly what that means.

- Mistake #2: Not providing consistent guidance, direction, or accountability.

- Do this instead: People in our industry join teams and organizations because they want to be a part of something, and they want to be led. So, if you intend to be a great leader, you must be accessible, highly communicative, and model the high-minded behavior you expect from them.

- Mistake #3: Not helping your people or team members develop to their full potential.

- Do this instead: Consult with each team member and create an individualized growth plan. Where do their interests lie? What skills and proficiencies can be improved over the next quarter and year? What impact could this have on their performance and your profitability? Be prepared to identify the people, platforms, courses, and resources to make it happen—and to invest the resources.

- Mistake #4: Failing to respect other people’s boundaries.

- Do this instead: Great leaders embrace their people and honor what’s important to them. Your team members want balance, which comes from boundaries. Pay attention to how you spend your time and what your people observe you do. Be willing to share your challenges and desire to make positive, impactful changes. Reinforce their boundaries and balance, and seek a peer group to do the same for you.

- Mistake #5: Not recognizing a job well done.

- Do this instead: While it’s easy and maybe even second nature for leaders to identify what someone is doing wrong, you’ll be better respected and earn greater loyalty when you pay attention to what your people are doing right. So praise them, thank them, surprise and delight them, and be the leader others love to work with.

- Mistake #6: Making big, business-impacting decisions without consulting those you lead or other team members.

- Do this instead: If you’re a smart leader, you’ll ask for suggestions, consider their opinions, and include them in your decision-making process. If you don’t, things can go terribly wrong.

- Mistake #7: Micromanaging and expecting perfection from your team.

- Do this instead: Tell your team what you want and let them do their work. Trust them and talk to each other. Everyone is good at different things, so listen when they tell you stuff. Don’t watch them all the time. Help them when they need it. This will make work better for everyone.

Pro Tip

Pro Tip

Good people don’t leave good jobs. They leave lousy leaders.

FAQs

What is a real estate teamerage?

A teamerage is a real estate brokerage managed and run more like a team than a traditional one. Think of it as a smaller, more collaborative alternative to a boutique brokerage. For many agents, teamerages offer the best of both worlds. They get the training, support staff, higher splits, and independence of a traditional brokerage and the one-on-one mentorship provided by team leaders.

I’m a new agent. Should I join a real estate team or a teamerage?

If there are teamerages in your market and you have at least a year of experience, we recommend joining a teamerage over a team. In a teamerage, you will have more opportunities to build your brand and generate leads without the hassle of leaving your current team or finding a new brokerage.

What qualifications do I need to start a real estate team?

You can start a real estate team as a licensed real estate professional. Most teams are started by agents or associate brokers who have reached the business limit they can do themselves because they’ve got more leads than they can serve on their own.

However, teams are also started by agents or brokers who want to diversify the services they can offer their clients (for example, by bringing on a commercial specialist or an agent who specializes in rental management) or agents who want to help bring down their operating costs by sharing them across a group.

How do real estate team members get paid?

The team leader determines the compensation model for a real estate team. Some team members (like real estate assistants or marketing specialists) are typically salaried or paid by the hour since their positions don’t require a real estate license or their work doesn’t directly result in closed deals. Licensed team members, like the team leader, buyer’s agent, or listing specialist, typically get paid exclusively by commission.

Bringing It All Together

Building a real estate team is a fantastic way for successful agents to scale up their business and for new agents to break into the industry and learn from seasoned pros. Are you a part of a real estate team? What advice would you give to agents wondering how to start up a squad or choose a company to work for? Tell us in the comments below.

The post How to Build a Real Estate Team in 7 Steps + Mistakes to Avoid appeared first on The Close.

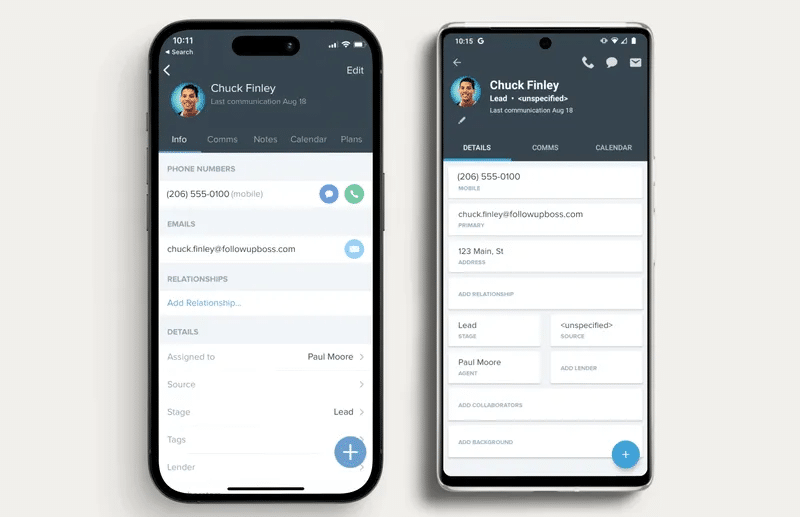

Follow Up Boss (FUB) is a powerful real estate customer relationship management (CRM) software. The tool significantly improves how agents and brokerages handle their everyday and long-term client relationships. It helps real estate professionals with client communication, optimizes lead management, and boosts overall productivity. Our Follow Up Boss CRM review will cover detailed features, usability, pricing, and overall effectiveness. Let’s dive into the findings!

My Verdict on Follow Up Boss & Why You Should Trust It

As a real estate technology expert with years of experience implementing these tools within a brokerage, I bring a great deal of knowledge and insight into my software reviews. My thoughts on Follow Up Boss are that it’s a powerful, all-inclusive real estate-specific CRM solution. Beginning with an easy-to-use interface and robust automation features, the platform’s ability to handle vital tasks for agents and brokers makes it an extremely valuable tool.

While Follow Up Boss offers numerous benefits, there are some drawbacks. The platform is priced for all the bells and whistles it comes with, but that can be a bit pricey for a smaller team or an independent agent. They also charge fees for added features like marketing tools, lead automation, and website and landing pages.

My Follow Up Boss review determines that it’s a solution that can handle everything from effectively managing leads to building strong relationships with clients in the most professional way. It’s a game-changing tool to support agents, increase productivity, and help create strong real estate results. It contains all the features that every agent should want to see in their CRM.

Follow Up Boss Alternatives

Although FUB real estate has a well-rounded set of features for real estate professionals, there are a few reasons for looking for an alternative solution for a real estate CRM. Each real estate business is different; hence, what works well for one firm may not be suitable for another. That may be due to certain feature specifications, budget, integration constraints, or the user’s preference. Here are a few alternatives to consider:

| Platform | Why It’s a Great Alternative | Learn More | Ready to Purchase? |

|---|---|---|---|

| Offers live chat customer support | LionDesk Review | Visit LionDesk | |

| Highly rated by customers | Real Geeks Review | Visit Real Geeks</center | |

| Affordable monthly plans | Pipedrive Review | Visit Pipedrive |

| Platform | Why It’s a Great Alternative | Learn More | Ready to Purchase? |

|---|---|---|---|

| Offers live chat customer support | LionDesk Review | Visit LionDesk | |

| Highly rated by customers | Real Geeks Review | Visit Real Geeks | |

| Affordable monthly plans | Pipedrive Review | Visit Pipedrive |

Follow Up Boss Reviews: What Current Users Think

Customer feedback is crucial to evaluating any CRM platform. Understanding the experiences and views of Follow Up Boss customers will allow any agent interested in the platform insights into the benefits and potential drawbacks they may encounter. The platform received an overall customer rating of 4.6 out of 5 on G2. Below, I’ve compiled some direct quotes from customer reviews that will give you a vivid picture of how this CRM fares in the real world.

“It’s user friendly but if you have questions support is super responsive by phone or email. Also, assigned an account manager. One of my favorite things they do is video examples step by step from my account. The smart lists are a no brainer for efficiency snd most of all the community is incredible. Top producer are in there ready to share their processes and moderators will even @ mention the best person to help you.”

“Love how it integrates with my website. Offers a very clean and intuitive interface to maximize follow-up with clients/prospects. And let’s talk about the amazing automations and how AI helps drive the software….just awesome!”

“Follow Up Boss is unmatched compared to other CRM’s out there. There is a wealth of info, resources, and support as well as successful lead conversion!”

It’s also important to look at some of the negative reviews for Follow Up Boss to obtain the best understanding of the platform’s performance and value.

“The app sucks and the most simple things like logging calls and looking up people don’t work properly a good portion of the time. Have brought issues to their attention and have even corresponded with the owner or CEO Dan Corkill and it doesn’t look like they have taken any action.”

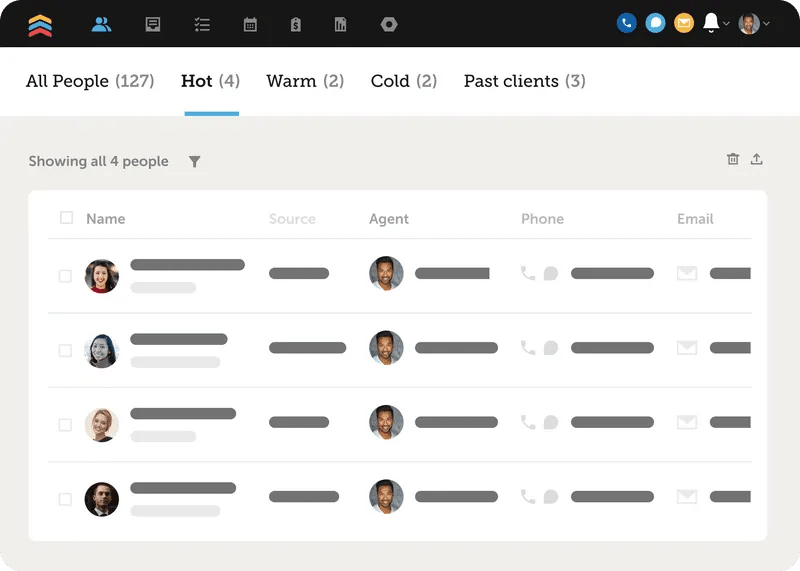

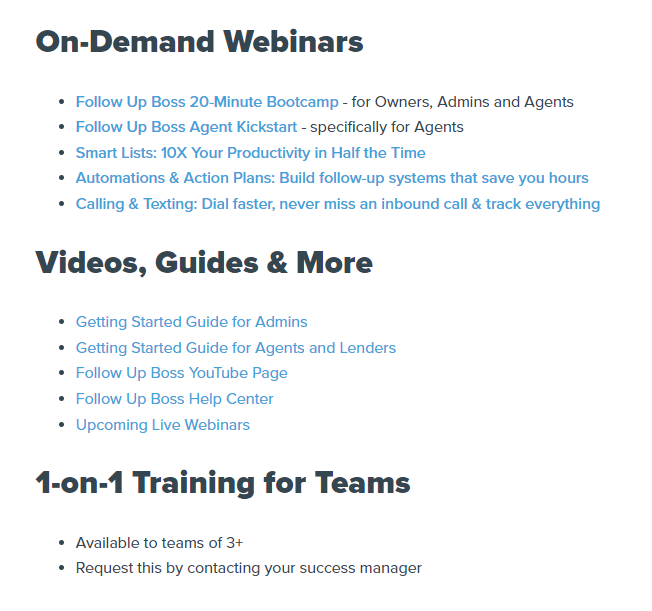

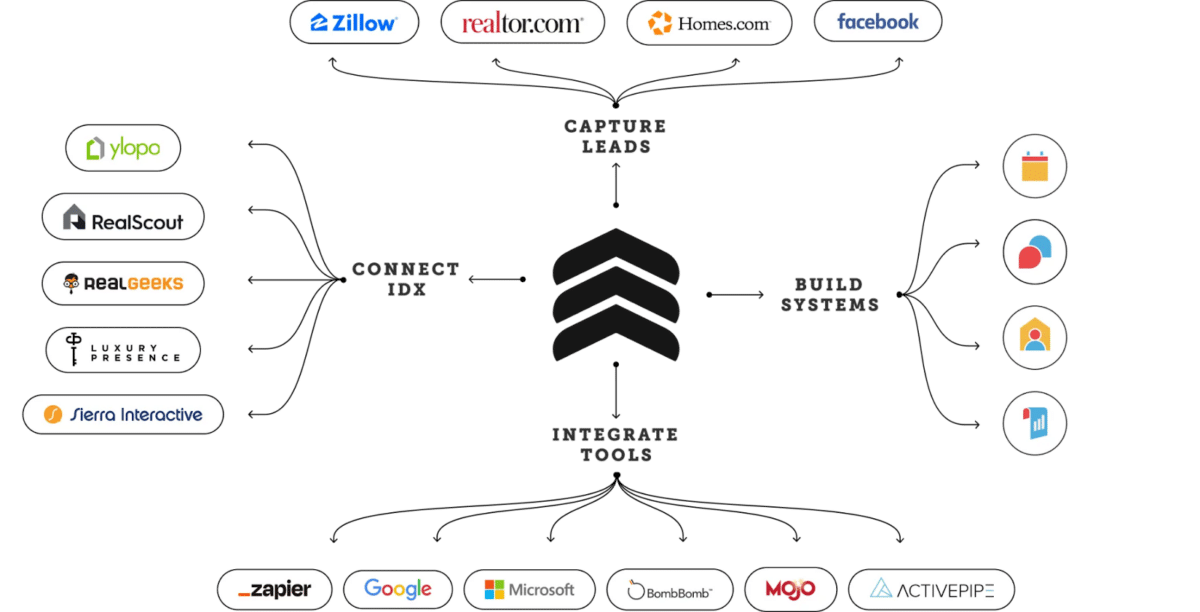

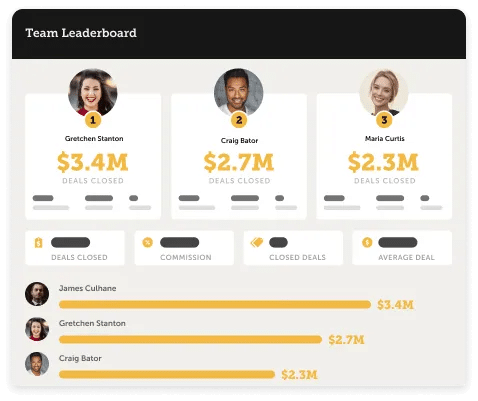

Key Features of Follow Up Boss